Southern Trust

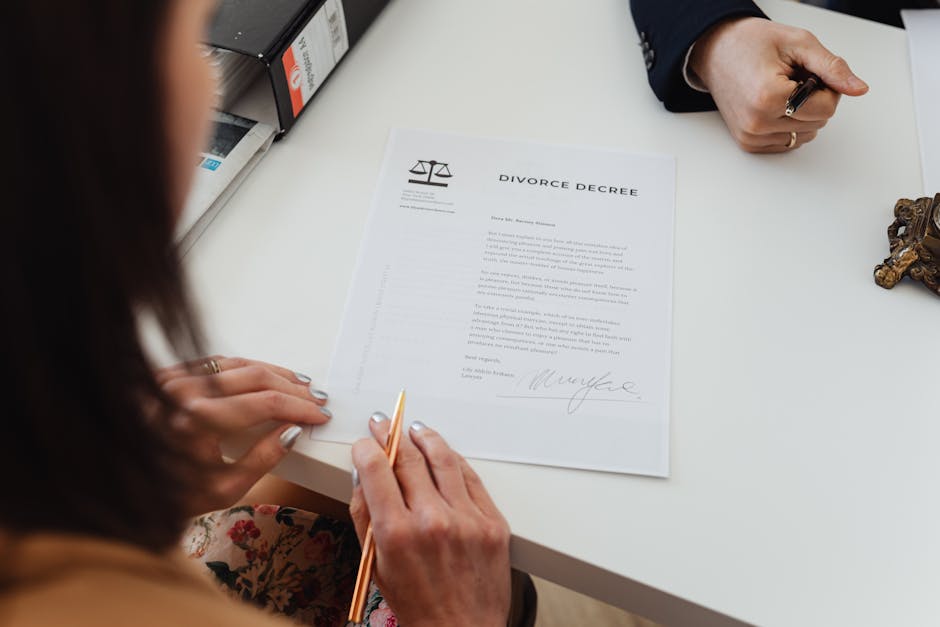

Southern Trust Family Planning: A Guide to Preserving Legacy and Family Harmony

Navigate complex southern estate planning challenges with practical trust strategies. From Texas ranches to Georgia businesses, protect wealth while preservi...